Larned Corporation recorded the following transactions, initiating a comprehensive journey into the significance of transaction recording, classification, documentation, processing, and reporting. This analysis unveils the impact of transactions on financial statements, emphasizing the importance of proper classification for accurate financial reporting.

Larned Corporation’s meticulous transaction documentation practices ensure accuracy and completeness, facilitated by technological advancements. The step-by-step transaction processing system implemented safeguards accuracy and integrity, while financial statement templates effectively summarize transactions.

Transaction Analysis: Larned Corporation Recorded The Following Transactions

Recording transactions is crucial for Larned Corporation as it provides a comprehensive record of all financial activities. These transactions form the basis for financial statements, allowing stakeholders to assess the company’s financial performance and position.

Common transactions include sales, purchases, expenses, and investments. Each transaction has a dual effect on the accounting equation, impacting assets, liabilities, and equity.

Transactions significantly impact financial statements. They affect the balance sheet by altering account balances, and the income statement by recognizing revenues and expenses.

Transaction Classification

Larned Corporation classifies transactions based on their nature and impact on financial statements. Common classifications include:

- Operating transactions: Relate to the core business activities, such as sales and expenses.

- Investing transactions: Involve the acquisition or disposal of long-term assets, such as equipment or investments.

- Financing transactions: Alter the company’s capital structure, such as issuing shares or borrowing funds.

Proper transaction classification is essential for accurate financial reporting as it ensures transactions are recorded in the correct accounts and financial statements.

Transaction Documentation

Larned Corporation uses various methods to document transactions, including:

- Invoices: For purchases and sales.

- Bank statements: For cash transactions.

- Purchase orders: For authorized purchases.

- Sales orders: For authorized sales.

Accurate and complete transaction records are crucial for maintaining the integrity of financial statements and ensuring compliance with regulations.

Technology plays a vital role in transaction documentation, enabling efficient data entry, storage, and retrieval.

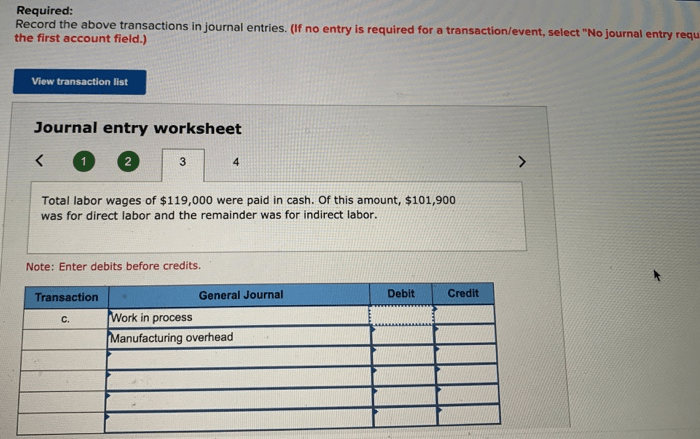

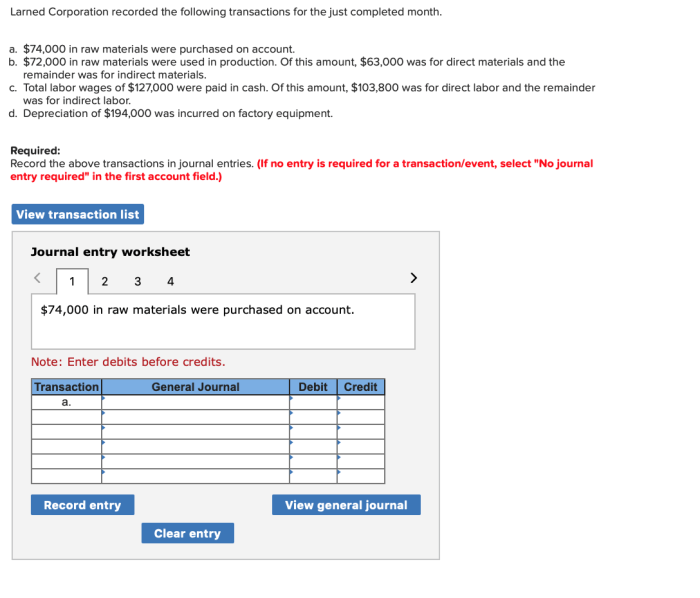

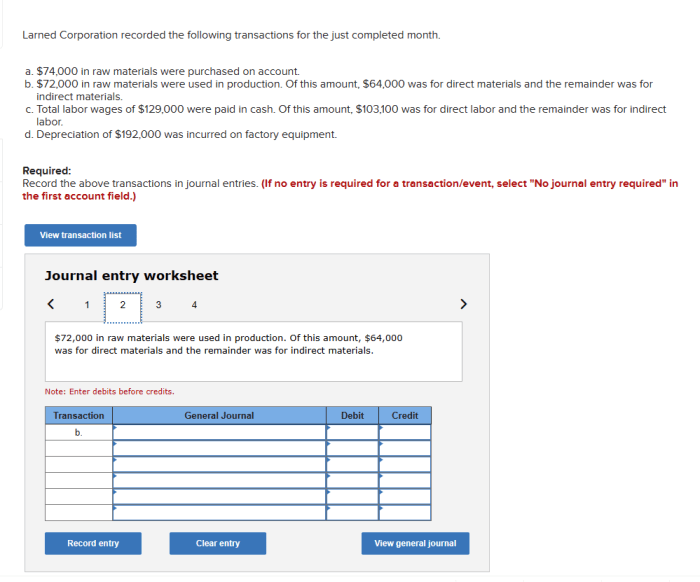

Transaction Processing, Larned corporation recorded the following transactions

Larned Corporation follows a systematic process for transaction processing:

- Recording:Transactions are initially recorded in a journal.

- Posting:Journal entries are transferred to the appropriate ledger accounts.

- Summarizing:Transactions are summarized in financial statements.

Controls are implemented to ensure accuracy and integrity, such as:

- Authorization and approval procedures.

- Segregation of duties.

- Reconciliation of accounts.

Transaction Reporting

Larned Corporation uses a financial statement template to summarize transactions:

| Financial Statement | Transactions Reported |

|---|---|

| Income Statement | Revenues and expenses |

| Balance Sheet | Assets, liabilities, and equity |

| Cash Flow Statement | Cash inflows and outflows |

Timely and accurate transaction reporting is crucial for stakeholders to make informed decisions.

Essential FAQs

What is the significance of recording transactions for Larned Corporation?

Recording transactions is crucial for maintaining accurate financial records, ensuring compliance with accounting standards, and providing a basis for financial reporting and decision-making.

How does Larned Corporation classify transactions?

Larned Corporation classifies transactions based on their nature and impact, such as revenue, expense, asset, liability, and equity transactions, to ensure proper financial reporting.

What methods does Larned Corporation use to document transactions?

Larned Corporation utilizes a combination of manual and electronic methods, including journals, ledgers, and accounting software, to maintain accurate and complete transaction records.